In South Korea, 84.2% of the population (48.5 million people) live in urban areas, which tends to facilitate the deployment of electronic communications networks.

According to the FTTH Council, this country has the highest household fibre penetration rate, with an FTTx residential penetration rate of about 52%, with FTTH penetration reaching about 16%.

Data from the OECD, referring to June 2010 shows that South Korea has approximately 16.8 million fixed broadband subscribers and 46.3 million mobile broadband subscribers 1, contributing to a joint penetration of 34.4 subscribers per 100 inhabitants.

Fibre, which is growing, represents about 52% of all fixed broadband subscriptions, while XDSL is in relative decline.

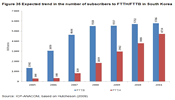

According to forecasts stated by Ovum Consulting, the number of FTTX subscribers in South Korea will reach about 10.5 million in 2011, as shown in Figure 35.

Figure 35 - Expected trend in the number of subscribers to FTTH/FTTB in South Korea

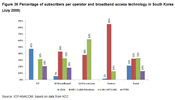

The three largest operators, KT 2 (Korea Telecom), SK Broadband 3 and LG Powercom 4, dominate the broadband market with a very significant combined share.

The relative weight of access technologies in the broadband market in July 2009 is shown in Figure 36. The access market is dominated by LAN (5.3 million subscribers) and HFC (5.2 million subscribers) whereas XDSL (3.5 million subscribers in total) is mainly used by KT. FTTH covered 2.1 million subscribers.

Figure 36 - Percentage of subscribers per operator and broadband access technology in South Korea (July 2009)

The fibre technology used by KT is almost exclusively EPON (see Figure 37), whereas the cable operator SK Broadband, which develops HFC and DOCSIS 3.0, opted for GPON. 5 It is noted that KT launched the world's first commercial FTTH offer-based on WDM-PON (Wavelength Division Multiplexing-Passive Optical Networks) in May 2005, using an FTTP service. 6 In 2007, KT announced a partial disinvestment from this technology due to the higher investments required 7.

Figure 37 - KT broadband subscribers according to the different technologies

In terms of FTTH, in November 2009, the total number of subscribers was reported at about 2.4 million, shared by KT (67%) and SK Broadband (33%).

To achieve the reported penetration levels, the approach taken by the government has been key.

In 1987, the South Korean government established a national policy for the development of information technologies in the public and private sectors through a "Framework Act on Informatization Promotion". 8 This law established the National Information Society Agency (NIA), with a mission to oversee the construction of high-speed information transmission networks, the use of ICT by government agencies and programmes to promote public access to broadband and literacy digital.

In 1994, the NIA established the Korean Information Infrastructure initiative (KII), with the aim of building a national optical fibre network. This programme would be supplemented with other government programmes 9 to be developed over five years and combining government support with private sector contributions 10 - with the aim of developing an integrated NGN network enabling affordable access "anytime" and "anywhere" with the convergence of multimedia services (telecommunications, radio and Internet), allowing provision of residential services using the fixed network at speeds of between 50 Mbps to 100 Mbps and providing mobile subscribers with speeds in excess of 1 Mbps. Additionally, the government created several agencies to promote access to broadband, in both the public and private sectors. 11

The KII was key in South Korea's successful evolution to NGA. This strategic programme included direct and indirect support from the government for the development of broadband infrastructure, through loans and other incentives, and covered three sectors; it was conducted in three stages: the KII-G sector (government), KII-P sector (private companies) and KII-T (tests to be conducted by research bodies, "Korea Advanced Research Network - KOREN"), as can be seen in Table 4.

|

|

KII-G |

KII-P |

KII-T |

|

Main participant |

Government |

Household and business sector |

Research centres and universities |

|

Investor |

Government |

Private |

Government and Private |

|

Main objective |

Backbone |

Access |

Tests ("testbed") |

|

Phase I (1995-1997) |

Connect 80 zones |

Fibre placement in large buildings |

2.5 Gbps between Seoul and Taejon |

|

Phase II (1998-2000) |

Connecting 144 areas with ATM services |

30% of all family households with ADSL or CATV |

GigaPoP 12 |

|

Phase III (2001-2005) |

Upgrade up to Tera bps |

Over 80% of family households with access to 20 Mbps connection |

Whole optical network |

Source: Lee et al (2001)

The government invested 17 billion euros 13 in the construction of basic infrastructure ("backbone") for a nationwide public high-speed Internet network, which operators can use to develop the offer of services to about 30 000 government agencies and research institutes and some 10 thousand schools. The KII-T would enable companies to use laboratory centres for measurement and testing for research and development. Simultaneously, the KII-P sector worked to encourage private funds to build the access network to homes and businesses with the aim of stimulating the development of broadband at the "last mile".

The KII program was supported jointly by government and the private sector, with the government releasing 1.3 billion euros in loans between 2000 and 2005 at reduced costs through the "Public Fund Program", while the private sector invested 10.8 billion euros, resulting in a joint public-private investment of about 12.1 billion euros. 14

Additionally, to stimulate demand for broadband, the government allowed small and medium companies to enjoy a tax exemption rate of 5% of the total that they invest in broadband communications. In addition, some 10 million Koreans were trained in the use of ICT.

As such, the government acted as the nation's most active force in the development of the network, both on the supply side and on the demand side.

This pattern, where it is expected that the private sector will drive investment in broadband infrastructure, with the State providing support through subsidies and loans, continued to be followed in the programs which followed KII. In the IT839 and BCN programmes, the government provided more than 52.2 billion euros 15 in low cost loans, while the operators were asked to make an equivalent investment of their own.

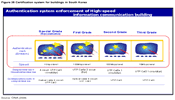

Another aspect that has greatly contributed to the development of broadband in South Korea was the government's introduction in May 1999 of a programme of certification of buildings in terms of broadband Internet connection "The Korean Cyber Building Certificate System" to accelerate the expansion of broadband Internet services. 16

The programme applies to residential buildings with more than 50 residential units and commercial buildings with areas exceeding 3300m2, and there are currently four classes of certification (1st, 2nd, 3rd and "premium") to identify buildings equipped with 100 Mbps, 10-100 Mbps, 10 Mbps and 1 Gbps, respectively (see Figure 38).

In regulatory terms, one of the most important steps was taken in 2003. The MIC (Ministry of Information and Communications) made an amendment to the directive governing the sharing of facilities and equipment to include fibre as one of the wholesale products. The directive set out rules to be applied to the SMP operator (KT) in order to allow access to fibre, leased lines, ducts and masts.

Figure 38 - Certification system for buildings in South Korea

During this process of reviewing the regulatory aspects related to optical fibre, KT argued that allowing fibre access to alternative operators was inconsistent with fair competition policies, since fibre technology is an innovation and depends on the investments of the operators. Therefore, if some regulation of fibre was imposed on KT, the operator would allegedly have no incentive to develop fibre voluntarily and this may impede the desired migration to fibre in South Korea

MIC accepted KT's arguments, opting for a hybrid regime of fibre regulation. Therefore, the obligations of KT with respect to optical fibre were as follows:

a) Until 2004, KT had to allow fibre access to alternative operators, with wholesale prices regulated by the MIC;

b) After 2004, the MIC did not impose any kind of regulation on KT in terms of tariffs.

Following the NCB programme, in January 2009, the government launched a new programme 17 for a very high speed convergence network "Ultrabroadband convergence network - UBCN", to be carried out between 2009 and 2013, for the development of fixed broadband - with speeds at home of 1 Gbps 18 and mobile broadband - 10 Mbps. This project established the state of art at a global level. In 2013, it is expected that fixed or mobile Internet speeds will be ten times the current speed and ultra-definition television "Ultra Definition TV - UDTV", will be four to sixteen times sharper than current high-definition television "High Definition TV - HDTV".

The objectives of this programme, in terms of developing the fixed Internet network, are shown in Table 5. The total cost of the project is estimated at about 21.3 billion euros 19, with central government financing about 4% of that value. It is expected that this project will create 120 thousand jobs. 20

|

Network |

2009-2010 |

2011-2013 |

|

Broadband (50-100 Mbps) |

12 million subscribers |

14.5 million subscribers |

|

Ultra Broadband (max. 1Gbps) |

N.A. |

Commercial services launched in 2012 and 200,000 subscribers in 2013 |

Source: KCC

KT plans to invest about 312 million euros 21 between 2008 and 2015 in order to achieve national FTTH coverage of 100% by 2015 - with an interim target of 92% by 2010.

KT's FTTH investment plan for the next years outlined in Table 6.

|

|

2009 |

2010 |

2011 |

2012 |

|

Investment in € million |

37 |

44 |

40 |

39 |

Source: Hutcheson (2009)

In late 2009, KT was made subject to the obligation to grant access to exterior ducts, as well as those installed inside buildings. KT is expected to increase sharing of their ducts from 5% in 2010 to 23% in 2014.

South Korea has made the deployment of broadband a national issue, with the government emerging as the agent with the most capacity to foster deployment of NGN networks, acting both on the supply side and on the demand side, involving the whole of society through transverse programmes and using the incumbent as a favoured instrument for deploying NGN.

The situation in South Korea is very different from the one in Portugal, although to some degree, some points of coincidence with the national reality can be found. In fact, in Portugal, programmes such as the "e.initiativas" programmes or tax benefits associated with the purchase of computers have been perceived as stimulants to demand. Meanwhile, in addition to the response of operators to growing demand, there was also been an effort in Portugal to create incentives to supply, such as NGN tenders in rural areas and the protocol made between the State and the operators.

1 The operator SK Telecom, one of the first advocates of WiMAX technology, announced that it would use Long-Term Evolution (LTE) to launch 4G services in Seoul during 2011. While the operator has not affirmed it abandonment of WiMAX, the company’s new strategy makes no mention of this technology.

2 South Korea's incumbent operator.

3 SK Broadband was previously known as Hanaro Telecom. In February 2008, it was acquired by SK Telecom which is part of the SK Group.

4 LG Powercom is part of the LG group.

5 Data from Ovum (published on 05.10.2009) - "The regulatory approach to next-generation access: Asia-Pacific".

6 This commercial offer was preceded by a trial conducted by KT between September and December 2003 with 73 subscribers. This experimental project, led to the establishment of a joint venture in 2005 between two equipment manufacturers, which since 24.07.2009 has offered the market the WDM-PON Ecosystem solution. WDM-PON is not yet standardized, enabling 1Gbps both upstream and downstream.

7 In May 2009, LG-Nortel and the government agency in South Korea, ETRI "Electronic Communications Research Institute" signed a memorandum of understanding in order to promote the standardization of WDM-PON technology.

8 Framework Act on Informatization Promotionhttp://unpan1.un.org/intradoc/groups/public/documents/APCITY/UNPAN025688.pdf.

9 Cyber Korea 21 in 1999, e-Korea Vision 2006 in 2002, IT Korea Vision 2007 in 2003 and in 2004 the IT 839 programmes (also called "u-Korea Master Plan") and Broadband Convergence Network (BCN).

10 The NCB's period of execution is between 2004 and 2010.

11 The "South Korean Agency for Digital Opportunity -KADO": was established to ensure that all citizens had ability to access the Internet, especially citizens with special needs (elderly and disabled) - through specific training programmes; the "Korea Information Security Agency - KISA" and the "Korea internet Safety Commission" to oversee security on the Internet and consumer protection; and the "National Internet Development Agency - NIDA" to promote the Internet society through education and through promotional programmes ("PC for Everyone" in 1996, "Cyber Korea 21" in 1999 to promote digital literacy and e-commerce.

12 Gigapop, abbreviation of "Gigabit point-of-presence" (Point of presence of Giga network).

13 24 billion U.S. dollars (exchange rate on 04.02.2010).

14 16.3 billion U.S. dollars (exchange rate on 12/04/2010).

15 70 billion U.S. dollars (exchange rate on 04.12.2010).

16 Regulatory Affairs Advisory Committee - Development of Broadband Infrastructure in Hong Konghttp://www.ofta.gov.hk/en/ad-comm/raac/paper/raac04_2009.pdf.

17 Since 1987, South Korea has launched a series of programmes to develop the communications sector, with several taking place simultaneously and contributing to the successful growth of broadband. 1987 saw the launch of the "Measures to nurture IT Industry (1987-1995)" programme, targeting industry and the "National Basic Information System (1987-1996)" programme focused on the administration, defence, public safety, finance and education. In 1995, the "Korea Information Infrastructure Initiative (1995-2005)" programme was launched, focusing on the development of a very high-speed national information network. In 1996, the country launched the "National Framework Plan for Information Promotion (1996-2000)" programme was begun, focusing on ten priority areas, with an annual action plan. In 1999, the "Cyber Korea 21 (1999-2002)" programme was launched, focused on developing a vision for the knowledge society and in 2002 the "E-Korea Vision 2006 (2002-2006)" programme was launched aiming to maximize the abilities of all citizens in the use of ICT. See http://www.itu.int/osg/spu/ni/promotebroadband/presentations/03-kelly.pdf.

18 This value is of downstream speed and of upstream speed, corresponding to a speed which is ten times faster than the current one.

19 24.6 billion U.S. dollars (exchange rate on 09.02.2010).

20 IT plan calls for big spending, jobs.http://joongangdaily.joins.com/article/view.asp?aid=2900490

21 500 billion South Korean Won (exchange rate on 09.02.2010).

22 Investment in billions of South Korean Won: 2009-60, 2010-70, 2011-65 and 2012-62 (exchange rate of 09.02.2010).