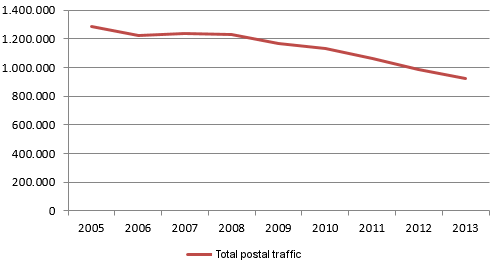

In Portugal1, during 2013, around 927 million postal items were sent, 6% less than in 2012 (Figure 1). This decrease is close to the annual average reduction registered since 2007 (-5.7%) for total postal traffic.

It is estimated that, in 2013, around 50.2% of total postal traffic consisted in bulk mail.

Figure 1 - Evolution of total postal traffic

Unit: Thousands of items.

Source: ICP-ANACOM (“State of Communications" reports).

As regards the evolution of traffic per type of service, the growth of the segment of courier services must be stressed (9.9% in 2013), which in that year represented 4.7% of total traffic.

On its turn, postal traffic not covered by the courier mail category, which represented 95.3% of total traffic, registered in 2013 a decrease by 6.7%. In the last five years, this type of traffic decreased on average around 6.2% per year.

The universal service represents 88.8% of total postal traffic and around 93.2% of postal traffic not covered by the courier mail category. In addition to CTT, 6 other bodies registered activity in this category. Nevertheless, the universal service provider (CTT) holds very high postal traffic shares.

Notwithstanding European Directive 2008/6/EC, focused on the provision of postal services under a full competition regime, and its transposition into national laws of Member States, the entry of new providers in the market not covered by the courier mail (particularly correspondence) was weak in most EU countries2. Reasons for this vary according to Member State. Without prejudice, the general trend for a fall in the volume of correspondence postal traffic discourages the entry of new providers in this market.

In Portugal, during 2013, there were 90 providers qualified to provide postal services (regardless of whether their operation ceased in the course of 2013).

14 of these providers were qualified to provide services within the scope of the universal service. It must be referred that CTT Expresso and Transportes Azkar do not operate3 in this segment, as they focus exclusively on the provision of courier mail services.

Still in the scope of the universal service, a new license was issued to Greapost, Lda., which by the end of 2013 had not started its operations.

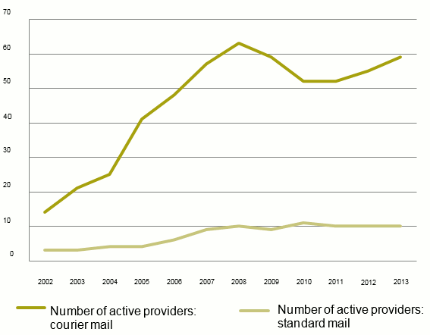

As such, in 2013, 10 providers were active in the scope of the universal service. Outside the scope of the universal service, there were 59 active providers (Figure 2).

Figure 2 - Evolution of active postal service providers

Unit: number of providers

In 2013, the CTT group achieved a market share of 94.7% of total postal traffic. No other provider achieved a total traffic share over 1% (Table 1).

|

|

2009 |

2010 |

2011 |

2012 |

2013 |

|

CTT group* |

97.6% |

97.1% |

96.7% |

95.9% |

94.7% |

|

Chronopost |

0.6% |

0.7% |

0.8% |

0.9% |

0.9% |

|

Vasp Premium |

0.5% |

0.5% |

0.5% |

0.6% |

0.7% |

|

Notícias Direct |

0.1% |

0.2% |

0.4% |

0.2% |

0.5% |

|

Rangel group |

0.0% |

0.3% |

0.3% |

0.4% |

0.5% |

|

Urbanos |

0.1% |

0.1% |

0.1% |

0.2% |

0.3% |

|

Iberomail |

0.1% |

0.1% |

0.1% |

0.1% |

0.3% |

|

DHL |

0.2% |

0.2% |

0.2% |

0.2% |

0.3% |

|

General Logistics Systems |

- |

- |

- |

0.1% |

0.3% |

|

SEUR group |

0.1% |

0.1% |

0.1% |

0.2% |

0.2% |

|

S.D.I.M. |

0.2% |

0.2% |

0.2% |

0.2% |

0.2% |

|

Best Direct |

0.0% |

0.0% |

0.0% |

0.1% |

0.2% |

|

Transportes Ochoa |

0.0% |

0.0% |

0.1% |

0.2% |

- |

|

Others |

0.3% |

0.4% |

0.5% |

0.7% |

0.8% |

Unit: %

Source: ICP-ANACOM

* Includes CTT, CTT Expresso and Post Contacto

The breakdown by type of service shows that the share of the CTT group remains high in the segment of services not covered by the priority mail category (98%), which includes the universal service, 0.7% less than in 2012 (Table 2).

|

|

2009 |

2010 |

2011 |

2012 |

2013 |

||

|

Courier service |

|||||||

|

CTT Group * |

37.3% |

31.5% |

29.3% |

28.9% |

27.3% |

||

|

Others |

62.7% |

68.5% |

70.7% |

71.1% |

72.7% |

||

|

Services not covered by the courier service category |

|||||||

|

CTT Group * |

99.0% |

99.0% |

98.8% |

98.7%

|

98.0%

|

||

|

Others |

1.0% |

1.0% |

1.2% |

1.3%

|

2.0%

|

||

Unit: % Source: ICP-ANACOM

* Includes CTT, CTT Expresso and Post Contacto It is likely that the decrease in correspondence traffic remains, associated to the economic crisis and intensification of cost-saving measures put in place by companies, associated to the tendency to replace physical mail by electronic communications. E-commerce may continue to have the effect of increasing parcel traffic, resulting from the need to distribute products purchased on-line (Internet).

1 The information presented below on the sector is based on “The Communications Sector 2013” report, published by ICP - ANACOM in June 2014.

2 ICP-ANACOM, based on studies prepared by WIK Consult and Copenhagen Economics for the European Commission.

3 An operator is deemed to have operated during a given period in case postal traffic is registered during that period.