Full version (PDF 430 KB)

Historical data of 'Facts & Figures' (XLS 139 KB)

This information is copyrighted to ANACOM

Subscribers

| 16Q3 | 17Q2 | 17Q3 |

Variation 17Q3/17Q2 |

Variation |

|

| Active mobile stations/ MTS subscribers | 17,143 | 17,139 | 17,577 | 2.6% | 2.5% |

| Active mobile stations with actual use | 12,715 | 13,008 | 13,138 | 1.0% | 3.3% |

| of which: users of 3G services and upgrades | 6,253 | 6,837 | 7,043 | 3.0% | 12.6% |

| of which: MBB Internet users | 6,144 | 6,720 | 6,951 | 3.4% | 13.1% |

| Fixed telephone service (direct access customers) | 3 898 | 3 908 | 3 924 | 0,4% | 0,7% |

| Subscription TV service (subscribers) | 3 639 | 3 722 | 3 755 | 0,9% | 3,2% |

| Fixed broadband Internet access (customers) | 3 146 | 3 268 | 3 312 | 1,4% | 5,3% |

Unit: Thousands, %

| 16Q3 | 17Q2 | 17Q3 |

Variation |

Variation |

|

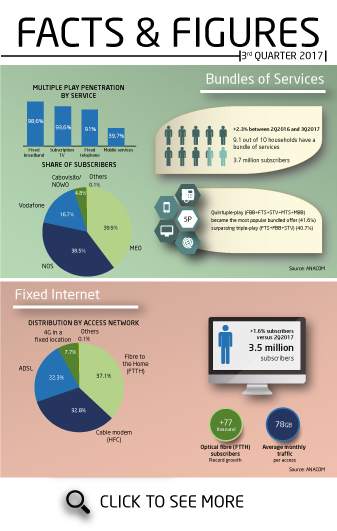

| Total subscribers to bundles of services | 3,442 | 3,613 | 3,696 | 2.3% | 7.4% |

| Double-play bundles | 502 | 516 | 531 | 2.9% | 5.7% |

| of which: FTS+FBB | 181 | 176 | 174 | -1.5% | -4.1% |

| of which: FTS+STV | 280 | 250 | 240 | -4.0% | -14.1% |

| Triple-play bundles | 1,414 | 1,492 | 1,518 | 1.8% | 7.4% |

| of which: FTS+FBB+STV | 1,388 | 1,475 | 1,502 | 1.9% | 8.2% |

| Quadruple/quintuple play bundles | 1,526 | 1,605 | 1,647 | 2.6% | 7.9% |

| of which: FBB+FTS+STV+MTS+MBB | 1,391 | 1,491 | 1,537 | 3.1% | 10.6% |

Unit: Thousands, %

Penetration

| Services | Penetration rate 17Q3 |

Penetration rate 16Q3 |

Variation 16Q3/17Q3 |

EU Average | Deviation from EU average | Most recent ranking (previous ranking) | |

| FTS | per 100 inhabs. | 46,6 | 46,1 | 0,5 | 42,1 | 4,5 | 7th (7th) |

| MTS | per 100 inhabs. | 170,5 | 165,8 | 4,7 | 137,6 | 32,8 | 4th (5th) |

| MTS actual use | per 100 inhabs. | 127,4 | 123,0 | 4,5 | n.a. | n.a. | n.a. |

| MTS actual use ex card and M2M | per 100 inhabs. | 113,9 | 109,9 | 4,0 | n.a. | n.a. | n.a. |

| FBB | per 100 inhabs. | 34,1 | 32,1 | 2,0 | 32,7 | 1,4 | 11th (14th) |

| MBB | per 100 inhabs. | 67,4 | 59,4 | 8,0 | 83,9 | -16,5 | 27th (25th) |

| MBB cards | per 100 inhabs. | 5,8 | 5,8 | 0,0 | n.a. | n.a. | n.a. |

| STVS | per 100 hshlds | 92,0 | 89,1 | 2,9 | 79,3 | 12,7 | 15th (11th) |

| CDS | per 100 hshlds | 33,2 | 32,8 | 0,4 | |||

| DTH | per 100 hshlds | 13,6 | 14,7 | -1,1 | 21,5 | -7,9 | 15th (13th) |

| IPTV | per 100 hshlds | 45,2 | 41,6 | 3,7 | 17,3 | 27,9 | 1st (1st) |

| Bundles | per 100 hshlds | 90,6 | 84,3 | 6,3 | 64,8 | 25,8 | 3rd (3rd) |

| 3P/4P/5P Bundles | per 100 hshlds | 77,6 | 72,0 | 5,6 | 34,9 | 42,7 | 1st (2nd) |

Note 1: Active mobile stations included in MTS

Note 2: EU average refers to values from December 2015, in case of FTS, July 2015 in case of STVS, July 2016 in case of FBB and MBB and bundles (referring to provisional data) and October 016 for MTS (provisional data).

Note 3: Portugal's EU ranking is determined based on information available from countries for the year being reported. In the case of the STVS, the information considered is the most recent information from each country. Croatia is included in the ranking from 2013.

Note 4: Use was made of most recent population estimates of population and private households after Census 2011. Data reference period: 31/12/2015 (population) and 31/12/2016 (private households).

Traffic

| 16Q3 | 17Q2 | 17Q3 |

Variation |

Variation |

|

| Mobile voice traffic (millions of minutes) (excluding roaming) | 6,490 | 6,638 | 6,758 | 1.8% | 4.1% |

| of which off-net traffic | 2,258 | 2,461 | 2,503 | 1.7% | 10.8% |

| SMS (millions) (excluding roaming) | 4,770 | 4,293 | 4,244 | -1,1% | -11.0% |

| Fixed voice traffic (millions of minutes) | 1,364 | 1,270 | 1,211 | -4.7% | -11.3% |

| FBB Traffic (TB) | 600,597 | 725,114 | 797,831 | 10.0% | 32.8% |

| MBB traffic (TB) | 33,405 | 46,346 | 56,306 | 21.5% | 68.6% |

| 16Q3 | 17Q2 | 17Q3 | |

| Mobile voice traffic by mobile stations with actual use (excluding cards/modem and M2M) / month | 190 | 191 | 193 |

| of which off-net traffic | 66 | 71 | 71 |

| SMS per SMS user/month | 211 | 187 | 185 |

| Fixed voice traffic (minutes) | 96 | 88 | 84 |

| No. of average monthly minutes of Fixed-fixed national calls | 75 | 69 | 64 |

| No. of average monthly minutes of Fixed-mobile national calls | 9 | 9 | 9 |

| FBB traffic (GB) per user/month | 62 | 72 | 78 |

| MBB traffic (GB) per user/month | 1,9 | 2,4 | 2,8 |

Note 1: Average monthly MBB traffic includes roaming out mobile traffic.

Revenues

| 16Q3 | 17Q3 | 17Q3/16Q3 | |

| Revenues from retail mobile services (1) | 1,027,597 | 993,150 | -3.4% |

| Revenues from standalone fixed services | 451,966 | 395,907 | -12.4% |

| Standalone FTS | 229,952 | 188,313 | -18.1% |

| Standalone FBB | 84,937 | 83,999 | -1.1% |

| Standalone STVS | 137,076 | 123,595 | -9.8% |

| Revenues from services offered in bundles | 1,250,353 | 1,323,884 | 5.9% |

| Double-play bundles | 106,276 | 99,415 | -6.5% |

| of which: FTS+FBB | 34,528 | 34,503 | -0.1% |

| of which: FTS+STV | 62,442 | 51,623 | -17.3% |

| Triple-play bundles | 402,158 | 420,168 | 4.5% |

| of which: FTS+FBB+STV | 387,771 | 410,066 | 5.7% |

| Quadruple/quintuple play bundles | 741,918 | 804,301 | 8.4% |

| of which: FBB+FTS+STV+MTS+MBB | 683,403 | 757,236 | 10,8% |

| Total | 2,729,166 | 2,712,941 | -0.6% |

Unit: Thousands of euros

(1) Revenues from Mobile Services which are not included in bundles with fixed services Includes revenues from the mobile component of bundles referring to additional traffic not included in the monthly subscription fee and Add-Ons.

Shares

| Total | Multiple play | Double play | Triple play | Quadruple/ quintuple play |

FBB+FTS+ STV+MTS +MBB |

||||||

| Fixed voice | FBB | STVS | Mobile voice | MBB | BLM-Cards | ||||||

| MEO | 44.9 | 39.5 | 38.1 | 43.8 | 38.3 | 34.0 | 39.9 | 43.4 | 32.7 | 45.4 | 48.0 |

| Grupo APAX | 3.8 | 4.3 | 4.7 | 0.7 | 1.1 | 0.0 | 4.8 | 8.3 | 5.5 | 3.2 | 2.7 |

| Cabovisão/Nowo | 3.4 | 4.2 | 4.7 | 0.7 | 1.1 | 0.0 | 4.8 | 8.3 | 5.5 | 3.2 | 2.7 |

| Onitelecom | 0.4 | 0.1 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Grupo NOS | 35.3 | 37.5 | 43.0 | 24.2 | 31.7 | 35.6 | 38.5 | 31.5 | 36.2 | 42.8 | 40.5 |

| NOS | 33.4 | 35.2 | 40.2 | 24.2 | 31.7 | 35.6 | 36.0 | 29.8 | 33.6 | 40.2 | 40.2 |

| NOS Açores | 0.6 | 0.8 | 0.9 | 0.0 | 0.0 | 0.0 | 0.8 | 0.6 | 0.8 | 0.9 | 0.0 |

| NOS Madeira | 1.3 | 1.6 | 1.8 | 0.0 | 0.0 | 0.0 | 1.7 | 1.2 | 1.8 | 1.7 | 0.3 |

| Vodafone | 15.7 | 18.5 | 14.0 | 30.0 | 28.6 | 30.4 | 16.7 | 16.4 | 25.7 | 8.6 | 8.8 |

| Others | 0.3 | 0.3 | 0.1 | 1.3 | 0.2 | 0.0 | 0.1 | 0.4 | 0.0 | 0.0 | 0.0 |

Unit: %

Note 1: Mobile voice subscriber shares calculated based on active mobile stations with actual use.

Nota 2: MBB - Use of mobile broadband Internet access service

Nota 3: On 15 September 2015, Altice announced an agreement with the APAX France investment fund on the sale of its Portuguese operators, ONI and Cabovisão. The transaction remains subject to approval by the European Commission and by Portuguese authorities. On 12 October 2015, Autoridade de Concorrência (Portuguese Competition Authority) was notified as to the acquisition of exclusive control of Cabovisão -Televisão por Cabo, Winreason and Oni SGPS by Cabolink, a company controlled by Apax Partners Midmarket SA and by Apax France.

|

|

Total (1) |

Fixed services (2) |

Mobile services |

Total Multiple play |

Double play |

Triple play |

Quadruple/ |

FBB+FTS+ |

|

MEO |

40.0 |

44.6 |

32.3 |

41.4 |

38.8 |

32.9 |

46.1 |

48.5 |

|

Grupo APAX |

2.0 |

2.8 |

0.4 |

3.3 |

11.0 |

4.9 |

1.6 |

1.4 |

|

Cabovisão/Nowo |

1.9 |

2.7 |

0.4 |

3.3 |

11.0 |

4.9 |

1.6 |

1.4 |

|

Onitelecom |

0.1 |

0.1 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

|

Grupo NOS |

31.4 |

39.0 |

18.4 |

40.6 |

32.2 |

38.9 |

42.5 |

40.2 |

|

NOS |

30.0 |

36.8 |

18.4 |

38.1 |

30.3 |

35.7 |

40.3 |

39.9 |

|

NOS Açores |

0.5 |

0.7 |

0.0 |

0.8 |

0.6 |

1.0 |

0.7 |

0.0 |

|

NOS Madeira |

0.9 |

1.5 |

0.0 |

1.7 |

1.3 |

2.1 |

1.5 |

0.2 |

|

Vodafone |

25.6 |

12.8 |

48.0 |

14.7 |

17.5 |

23.3 |

9.8 |

10.0 |

|

Others |

0.9 |

0.7 |

0.9 |

0.0 |

0.6 |

0.0 |

0.0 |

0.0 |

Note (1): "Total" retail revenues include Nomadic VoIP revenues

Note (2): Revenues from Fixed Services include standalone revenues from FTS+STV+IAS and Revenues from services included in bundles.