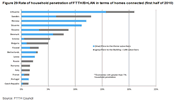

As at the end of the first half of 2010, Portugal occupied 16th position in the group of European countries with highest FTTH penetration, with a penetration rate reported of around 1.4%, according to the FTTH Council Europe (see Figure 29). According to the same source, there was a total of 52 500 FTTH customers on the same date.

Figure 29 - Rate of household penetration of FTTH/B+LAN 1 in terms of homes connected (first half of 2010)

Globally, the five economies that were at the top of the rankings in terms of the penetration rate of homes connected with FTTH/B were, at the end of the first half of 2010 and according to the FTTH Council, South Korea, Japan, Hong Kong, Taiwan and Lithuania.

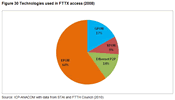

Data from the FTTH Council and IDATE, released in 2010 and referring to June 2009, show that, with regard to FTTX, FTTH and FTTB topologies remained the most widely used worldwide, with more than 62% of connected subscribers, followed by FTTX/LAN topologies (with 31% of subscribers) and VDSL (with 6% of subscribers). It is noted, however, that in Europe VDSL saw penetration at a rate nearly comparable to FTTH/B.

For such, it will be necessary to contend with the fact that these architectures, in particular FTTB, constitute the easiest solution for operators to increase their offer of bandwidth in different countries with densely populated areas, especially in Asia and increasingly in emerging countries, in addition to it being considered, compared to VDSL, more "future proof".

The technologies used in FTTX access are shown in Figure 30. EPON is the most widely used FTTX technology. It is noted that Asia, a pioneer in the roll-out of FTTX, uses this technology almost exclusively, with the main operators in Japan and South Korea its main promoters.

Figure 30 - Technologies used in FTTX access (2008)

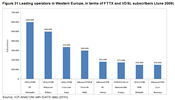

Note is made of the diversity of architectures used by different operators (see Figure 31).

Figure 31 - Leading operators in Western Europe, in terms of FTTX and VDSL subscribers (June 2009)

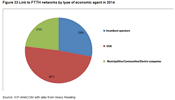

The dynamism of the alternative operators, which, according to IDATE data, represented 74% of the total FTTH/B subscriber base, is clear, as is the role of "utilities" and municipalities (together accounting for 9.6% of FTTH/B subscribers).

The incumbent operators, however, becoming more involved, representing 15% of FTTH/B passed homes in Europe in December 2009, including Russia (compared with 10% in June 2009). Alternative operators accounted for 74% of homes passed with FTTH/B in Europe and 24% of all subscribers.

Apparently, this trend seems to suggest an interdependent relationship between investment in NGA and the development of competition, with mutual reinforcement.

On the demand side, one of the most important aspects affecting the user take-up of FTTX is the price borne by the user when signing up to these new services. On the supply side, in many cases, operators want their customers to migrate from ADSL to FTTH/B so that they can begin to monetize their investments.

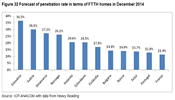

According to forecasts from Heavy Reading, in December 2014, the penetration rate in terms of FTTH homes in Europe, will be as shown in Figure 32. With regard to Portugal, these forecasts may be an underestimate, given the latest data on trends in the number of cabled and connected homes.

Figure 32 - Forecast of penetration rate in terms of FTTH homes in December 2014

The same forecasts suggest that connection to FTTH networks will be made by market agents distributed as shown in Figure 33.

Figure 33 - Link to FTTH networks by type of economic agent in 2014

According to IDATE data from 2009, regarding five operators from other countries (including Spain, France, Holland, Japan and Portugal), which offer both packages of 100 Mbps with ADSL2 and FTTH/B, it is clear that prices of package using fibre were higher, except in the case of France.

An examination of prices charged for broadband offers in different geographical areas showed clear differences between Europe, USA and Asia.

Prices in the United States were generally higher than those charged in Europe. For example, in April 2010, Verizon charged about 108 2 euros per month just for access with a downstream speed of up 50 Mbps. Interestingly, for a package "triple play" with downstream speed of up to 35 Mbps, telephone and television (including 385 digital channels and 90 HD channels), the operator, also requiring a loyalty period of two years, charges about 90 euros 3 per month.

This compared, for example, to 54.90 euros a month charged by one of the service providers in activity in Portugal in the first year of subscription (59.90 euros per month subsequently) for a "triple play" package including Internet access with downstream capacity of up to 50 Mbps, 116 TV channels and unlimited telephone calls to other national fixed networks and twenty international destinations (in this case from 9 pm). For 99.90 euros in the first twelve months (104.90 euros after twelve months), the same service offered a "triple play" package with downstream capacity of up to 200 Mbps, with the remaining services identical to those mentioned in the previous package.

The highest broadband speeds are available in Asia, where several operators, including HKBN in Hong Kong and KDDI in Japan, have announced offers with up to 1 Gbps. Simultaneously, Asia also seems to be the continent with the lowest prices for FTTH/B offers. For example, Taiwan's Chunghwa Telecom offers 100 Mbps access for a monthly fee of 25 euros and SK Broadband in South Korea, for the same access speed with television included, charges 24 euros per month.

The comparison of prices of packages offered by different providers, encompassing services supported by FTTH/B is complex, since there is considerable diversity among the services offered. Notwithstanding the differences between the specific characteristics of the services considered, a comparison between prices charged by service providers active in Europe and Asia with respect to "triple play" packages (including telephone services, television and Internet with downstream speeds of 100 Mbps), could suggest that prices in Portugal are likely to trend towards closer alignment with those charged in other countries.

Below, an outline is made of the current situation in Germany, Australia, South Korea, USA, Finland, France, Greece, Holland, Italy, Japan, New Zealand, United Kingdom, Sweden and Singapore.

1 Local Area Network.

2 144.99 U.S. dollars (exchange rate on 06.04.2010).

3 119.99 U.S. dollars (exchange rate on 06.04.2010).

- Germany https://www.anacom.pt/render.jsp?categoryId=340672

- Australia https://www.anacom.pt/render.jsp?categoryId=340673

- South Korea https://www.anacom.pt/render.jsp?categoryId=340674

- U.S.A. https://www.anacom.pt/render.jsp?categoryId=340675

- Finland https://www.anacom.pt/render.jsp?categoryId=340676

- France https://www.anacom.pt/render.jsp?categoryId=340677

- Greece https://www.anacom.pt/render.jsp?categoryId=340678

- The Netherlands https://www.anacom.pt/render.jsp?categoryId=340679

- Italy https://www.anacom.pt/render.jsp?categoryId=340680

- Japan https://www.anacom.pt/render.jsp?categoryId=340681

- New Zealand https://www.anacom.pt/render.jsp?categoryId=340682

- United Kingdom https://www.anacom.pt/render.jsp?categoryId=340683

- Singapore https://www.anacom.pt/render.jsp?categoryId=340684

- Sweden https://www.anacom.pt/render.jsp?categoryId=340685

- Summary of case studies https://www.anacom.pt/render.jsp?categoryId=340686