The high prices of telecommunications and the level of mobile broadband penetration and use in Portugal, when compared to the European average, could hinder the country's digital transition, according to the OECD. According to this organisation, the prices of electronic communications are relatively high in Portugal, and the number of mobile broadband subscribers per 100 inhabitants, as well as mobile data traffic per user, is around 30% lower than the OECD average. The same is reported for average download speed and 4G availability.

In its report, “OECD Economic Surveys: Portugal 2021” published this month, the OECD states that this situation “might partially explain the relatively low take up of mobile services and the large gap for Internet penetration by income level: Only around half of the poorest households had Internet at home in 2019”. The OECD notes that "the underlying causes for high price levels should be investigated further".

The organisation also claims that “competition pressures are relatively low in Portugal. The telecommunication markets are concentrated, with three operators holding significant market shares. Profit margins are high when compared to other European countries.”

“Operators mainly offer bundles of services and when doing so tend to mimic competitors’ offers (package and prices) or try to upgrade offers to higher priced service rather than decreasing prices.”

The OECD also recommends removing constraints to consumer mobility across telecommunications providers, for example, by restricting the use of loyalty clauses in contracts and providing clearer information on the quality of services.

The OECD considers that competition problems in the telecommunications sector go at least some way to explain pricing levels in Portugal.

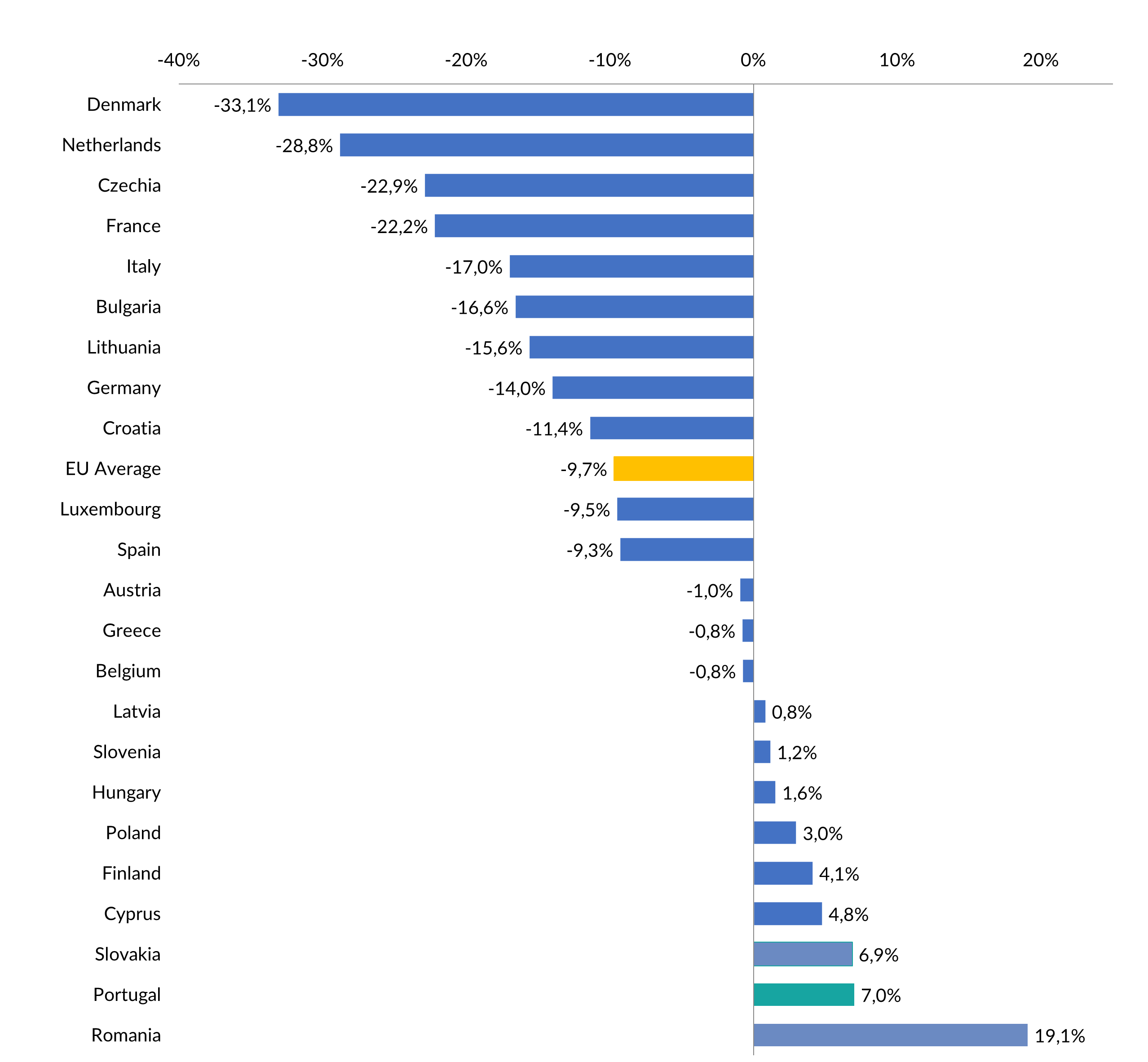

It should be noted that between the end of 2009 and November 2021, telecommunications prices in Portugal increased by 7%, while in the EU they decreased by 9.7%. The difference narrowed with the entry into force in 2019 of the new European rules that regulate the prices of intra-EU communications.

The difference between the trend in telecommunications prices in Portugal and in the EU (+16.7 percentage points, in accumulated terms) is due to price adjustments implemented by providers, normally in the first months of each year.

Figure 1 – EU telecommunications variation (HICP) between December 2009 and November 2021

Unit:%

Source: ANACOM, based on Eurostat data

Note: Information not available for United Kingdom, Ireland, Malta, Sweden and Estonia

Between January and November 2021, according to ANACOM's price analysis, telecommunications prices in Portugal increased by 0.6% due to the rise in monthly charges for bundled offers. In November, prices rose by 0.4%. Compared to the previous month, and mainly due to Black Friday promotions, prices dropped by 1.2%.

Compared to the same month of the previous year, there were 29 variations in the minimum monthly charges for services/offers, of which 16 were price increases and 13 were decreases.

By provider, MEO increased the minimum monthly charge for six services/offers. NOS increased the minimum monthly charge for five services/offers and reduced the monthly charge for two offers (mobile telephone service with mobile phone Internet – “Mundo” offer, and mobile broadband via PC/tablet - Black Friday promotion of the “Kanguru” offer). Vodafone increased the minimum monthly charge for three services/offers and reduced the monthly charge for two offers, including the mobile telephone service offer with mobile phone Internet and the mobile broadband Internet offer via PC/tablet. Meanwhile, NOWO increased minimum monthly charges for two services/offers and reduced minimum monthly charges for nine services/offers.

There were notable increases in the monthly charges for "quadruple and quintuple play" offers of MEO, NOS and Vodafone in May and June 2021.

Over the last twelve months, there were 35 increases and 24 decreases in minimum monthly charges compared to the previous month. In December 2020 there were 9 increases in minimum monthly charges due to the end of Black Friday promotional campaigns. In May and June 2021 there were price increases related to changes in bundled and single-play TV offers from MEO, NOS and Vodafone, and changes to the mobile telephone service offers (both stand-alone and bundled) from NOWO. In July 2021 there were increases due to the discontinuation of NOWO's TV option at 2.5 euros/month. In November 2021 there were 19 minimum decreases in the context of Black Friday promotional campaigns.

Consult the statistical report:

- Trends in telecommunications prices - November 2021 https://www.anacom.pt/render.jsp?contentId=1713966