ANACOM regularly assesses the operation of markets susceptible to sector regulation and, where necessary and appropriate, imposes specific obligations aimed at making markets more competitive and protecting the interests of citizens and other national economic actors. The preliminary assessment - also known as a market analysis - that ANACOM has now completed focuses on a number of markets relating specifically to the provision of fixed Internet access services.

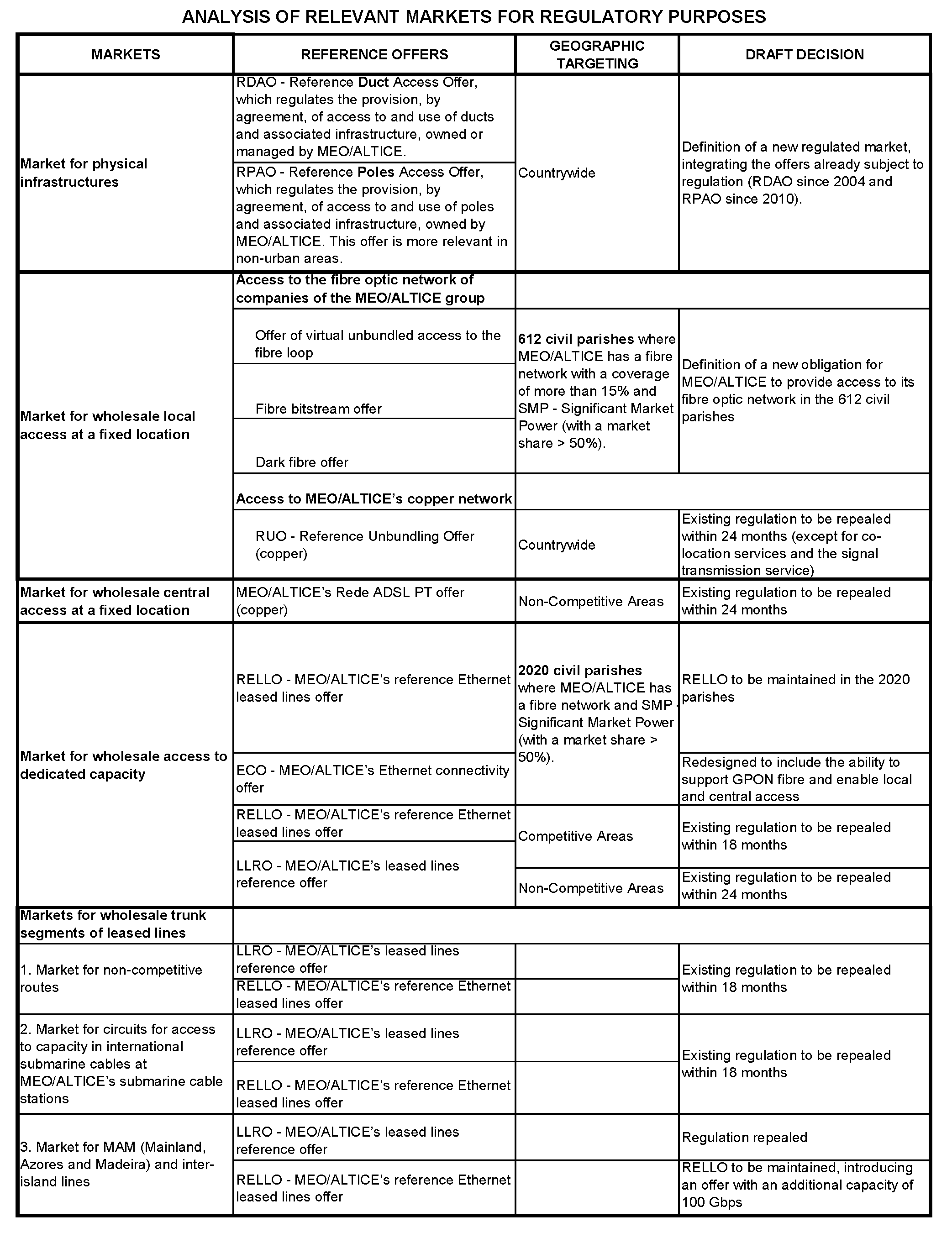

In this context, on 26 April 2023, ANACOM approved draft decisions (DD) on the following relevant markets: the market for physical infrastructure; the market for wholesale local access at a fixed location; the market for wholesale central access at a fixed location; the market for wholesale access to dedicated capacity; and geographic markets for wholesale trunk segments of leased lines, namely the market for MAM and inter-island lines. In these markets, MEO or the Altice Group companies have been found to have significant market power (SMP). This means that the company has an economic position that allows it to act to a large extent independently of its competitors, its customers and consumers in general, to the potential detriment of the latter. In order to counteract this dominant position, ANACOM imposes appropriate and proportionate obligations with the aim of promoting the emergence of competitive markets for the benefit of citizens and consumers.

Table 1 summarises the markets analysed, the respective results and obligations, namely as regards reference offers that were imposed in each market on MEO or on companies of the Altice Group, which consist of MEO, Fastfiber and Fibroglobal, the latter acquired in 2022 by Fastfiber.

Among the obligations imposed on MEO/Altice in the relevant markets, it is worth highlighting the maintenance of the obligation to provide a reference pole access offer (RPAO) and a reference duct access offer (RDAO) throughout the national territory. The possibility for alternative operators to MEO/Altice to use their poles and ducts to build their own networks has been important for the development of high-capacity Internet networks in the country and has proved to be crucial for the promotion of sustainable and strong competition, which preserves a high degree of autonomy for operators on the market.

Although a mandatory condition, the regulation of access to MEO’s physical infrastructure, namely to poles and ducts, has not been sufficient to promote competition in some areas of the country. In these areas, high-capacity networks competing with MEO’s have not been built, which demonstrates that there are barriers that need to be removed. Therefore, in the 612 civil parishes where there is no effective competition (Figure 1) and where it is not expected to develop within a reasonable timeframe, ANACOM considers that a new regulatory obligation should be imposed on Altice/MEO for access to its fibre network.

The aim is that access to MEO/Altice’s fibre optic network will enable operators to provide services to citizens and other economic agents of these civil parishes, who will benefit from a greater variety of services, more innovation and more competitive prices.

ANACOM therefore considers that a wholesale obligation for virtual unbundled local access (VULA) and an access obligation at a more centralised level (Ethernet bitstream offer) should be imposed, providing the alternative operator with connectivity at speeds configurable up to 1 Gbit/s between the aggregated access endpoint and the local access endpoint.

The wholesale offer to MEO/Altice’s fibre optic network in the identified civil parishes will be subject to a fair and reasonable pricing obligation, which will allow operators to develop retail offers and to provide their end-users with retail services typically available in the rest of the country in a cost effective manner.

Because of their importance in pursuing the objectives of promoting competition, in particular in the context of high-capacity networks and the provision of services over such networks, it is also worth highlighting the maintenance of other reference offers provided by MEO, such as the reference Ethernet leased lines offer (RELLO) and the Ethernet connectivity offer (ECO), the latter having been redesigned to allow the possibility of supporting point-to-multipoint fibre, as well as local and central access.

Finally, it should be noted that the evolution of markets shows that the copper network owned by MEO/Altice is becoming less important, in particular in view of the developments that have taken place at the level of high-capacity networks, which no longer justify the imposition of certain regulatory obligations aimed at the provision of the copper network. In this context, the obligation to provide the ADSL PT reference offer, the reference unbundling offer (RUO) and the leased lines reference offer (LLRO) will be removed after a transitional period of eighteen to twenty-four months.

The DDs approved by ANACOM will now be subject to a prior hearing of stakeholders and to the general consultation procedure for a period of 30 working days.

ANACOM will continue to promote the conditions for the sustainable development of competition throughout the country, including in more remote geographical areas with lower population density and per capita income levels. To this end, ANACOM will continue to adopt regulatory measures where objectively necessary (and to deregulate where appropriate), removing barriers to the provision of services by any competing operator, with the aim of protecting citizens and promoting the interests of end users.

Figure 1 – Civil parishes where there is no effective competition and where Altice/MEO must be required to provide access to its fibre optic network

(Click on the map to see the full list of civil parishes)

Consult:

- Consultation on markets for access to physical infrastructures, wholesale local access at a fixed location and wholesale central access at a fixed location https://www.anacom.pt/render.jsp?contentId=1744666

- Consultation on the market for wholesale access to dedicated capacity https://www.anacom.pt/render.jsp?contentId=1744779

- Electronic communications markets for trunk segments of leased lines https://www.anacom.pt/render.jsp?contentId=1744813